|

{{plan.plan | translatePlan:'en_US'}} N/A |

|

{{plan.plan | translatePlan:'en_US'}} N/A |

Part Time Opt In

Student Opt-In

Part Time/Graduate Student Opt-In

Choose Your Plan

Dependent Opt In

Family Opt In

Opt Out

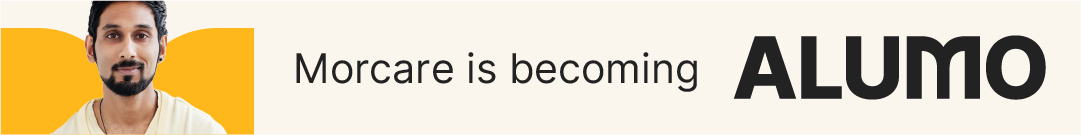

There is currently a temporary change to eProfile online claim submissions.

Please check that you are using the correct claim form for your claims. UPDATED individual claims forms are now available for international claims (hospital, emergency, lab); Drug Claim (Prescription only); Extended Health Claim Form, Vision Claim and Dental claim forms. Claim forms can be found via your school website, under Your Space.

All Drug, Dental, Extended Health and Vision claims must be mailed to: ClaimSecure Inc., P.O Box 6500, Station A, Sudbury, ON P3A 5N5

Should you have any questions, email help@morcare.ca

Please wait while your FlexPlan is registered.

Please wait while your FlexPlan is registered.